Latin America Retail Media Advertising Trends 2023: Digital’s Third Wave Brings a $1 Billion Opportunity to the Region

***Subscribers to Insider Intelligence | eMarketer can read the full report here.***

Report Snapshot

Latin America’s $1 billion retail media market boasts some of the highest return on ad spending in the world. Amid worsening economic conditions, marketers are turning to retailers to deliver performance advertising and results at scale. Flush with data and innovative ad formats, several retail media frontrunners are already emerging—and revolutionizing the ad industry as we know it.

Key Question: How are retail media networks changing the paid media mix in Latin America?

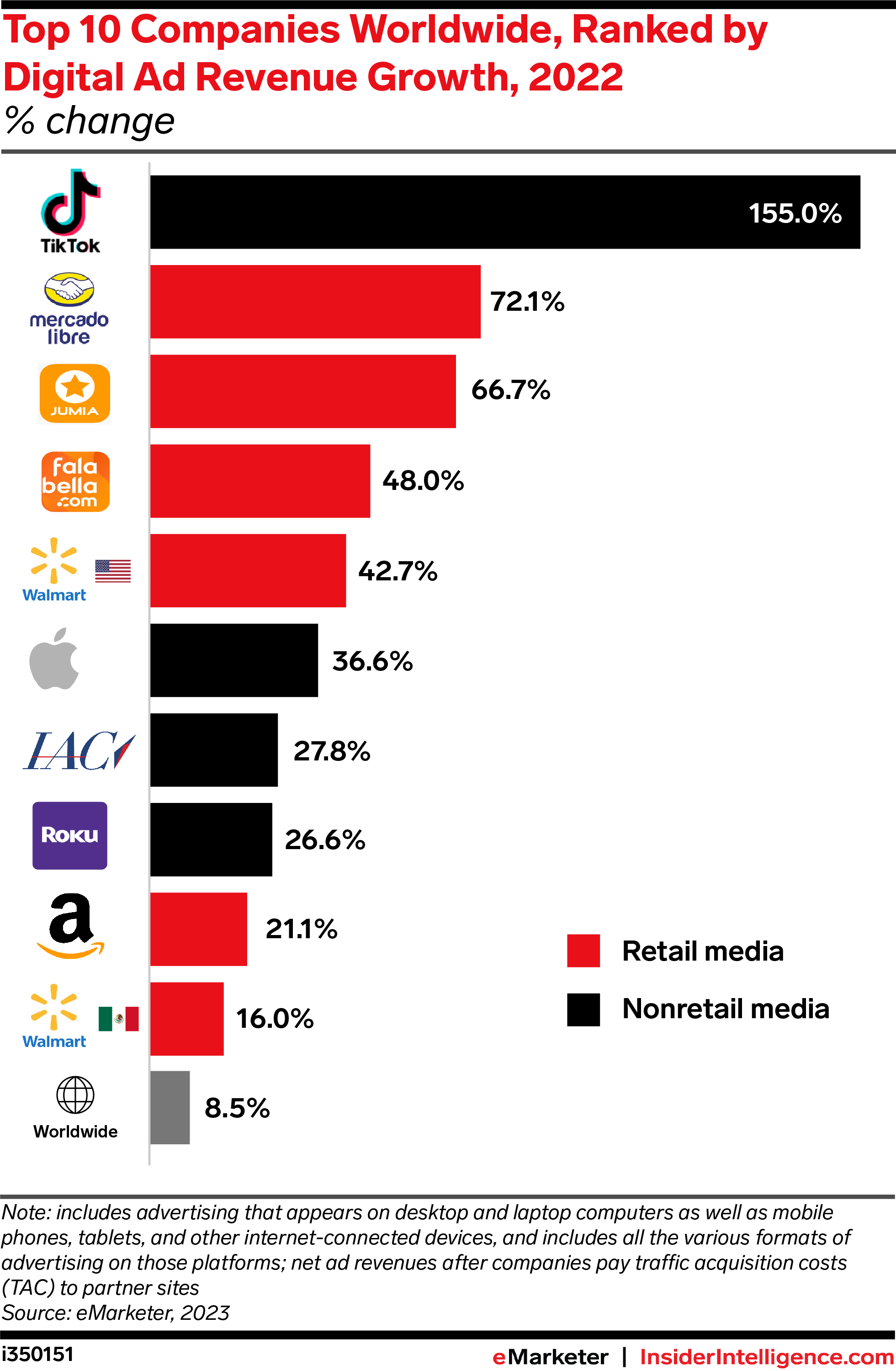

KEY STAT: Retailers were among the fastest-growing digital advertising players in 2022, according to our estimates. Three of Latin America’s most prominent retail and ecommerce players—Mercado Libre, Falabella, and Walmart Mexico—were among the leaders.

Setting the scene

The setting: The third wave of digital advertising is sweeping the shores of Latin America. Today, more than 15 retailers are vying for marketers’ dollars. Inflation-squeezed ad budgets are driving competition and innovation among retail media networks (RMNs), which have deployed a vast array of on- and off-site solutions to help marketers reach consumers close to the point-of-sale.

What happened: The rapid rise of retail ecommerce has transformed consumer behavior. When researching products, shoppers overwhelmingly prefer retailers’ platforms to traditional search engines and are swayed by ads there. These changes—along with the impending loss of third-party cookies—are prompting advertisers to go where consumers and data are.

The question: Why RMNs, and why now? The digital landscape will only become more fragmented, and retail media gives marketers the targeting, measurement, and attribution tools they need. And there’s no better region for it: Brazil and Mexico boast some of the highest return on ad spending (ROAS) in the world.