Online shoppers in Latin America turn to retailers’ websites instead of search engines for product research

This article originally appeared on Insider Intelligence’s blog. Click here to read this and other articles.

The trend: The preference of online shoppers in Latin America to conduct pre-purchase product research on search engines like Google is losing out to a new habit of researching via the sites of multicategory retailers like Amazon and Mercado Libre.

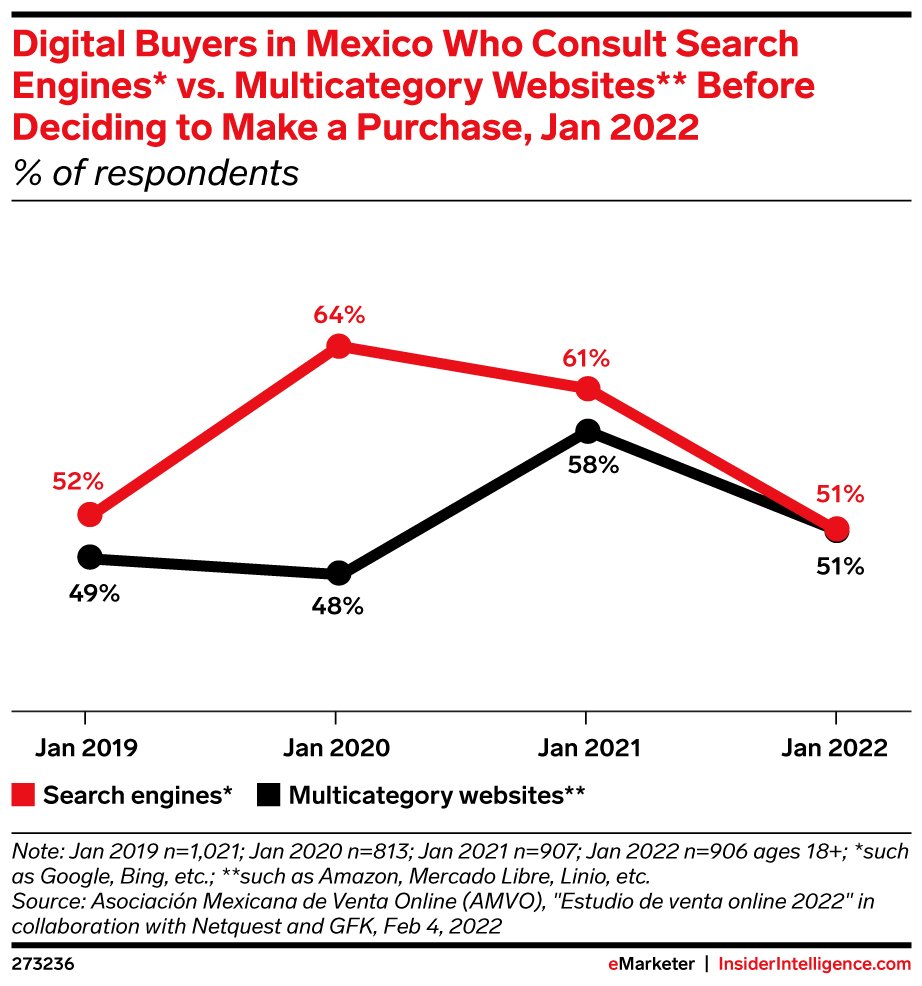

Among online shoppers in Mexico, those who turned to search engines before purchasing decreased from 64% to 61% between January 2020 and January 2021.

Meanwhile, those who turned to multicategory sites for their research rose from 48% to 58% over the same period.

However, as of January 2022, both groups had fallen to 51%, which could reflect changes in buying online versus in-store with more shoppers returning to physical locations.

What about mobile? Among smartphone users in Latin America, retailers’ digital properties (retail, multicategory, and digital marketplace websites and apps) were the most popular channel (43%) for consumer product research ahead of making a purchase online, per Livepanel.

Social channels and influencers came in second, at 41%.

Why this matters: The overarching trend of more consumers in Latin America turning to retailers’ digital properties to conduct product research presents new opportunities—and imperatives—for retailers and marketers doing business in the region.

The past two years have been tremendous for the development of retail media networks in Latin America, with eight companies either launching or rebranding their retail media solutions.

Both Mercado Libre’s and Amazon’s Mexico-specific domains saw audiences greater than those of the country’s top publishers last year, per Admetricks.

As ecommerce explodes, online marketplaces possessing robust first-party data sets like the aforementioned as well as Americanas S.A. and Magazine Luiza are uniquely positioned to offer ad targeting and closed-loop attribution for marketing efforts—and, ultimately, generate higher conversion rates and revenues.

Go further: To go in-depth on the big opportunities within the burgeoning retail media network landscape in Latin America, see our new report “Latin America Retail Media Advertising 2022.”