Latin America Retail Ecommerce Players Q2 2022 Review and 2023 Outlook: How 12 Companies Are Navigating a Rapidly Changing Landscape

Executive Summary

The latest installment in this series offers retail and ecommerce updates for 12 companies in Latin America, a summary of key trends, and their implications for the region’s retail industry.

3 KEY QUESTIONS THIS REPORT WILL ANSWER

How did retail ecommerce sales fare among Latin America’s most prominent players in Q2 2022, and which countries are affecting their growth?

To what extent has in-store shopping impacted these retailers’ bottom lines?

What do these trends mean for retail professionals heading into 2023?

WHAT’S IN THIS REPORT? Our analysis of retail ecommerce sales figures for 12 companies in Latin America during Q2 2022. Plus, key trends and developments impacting ecommerce growth amid a rapidly changing landscape.

Key Points

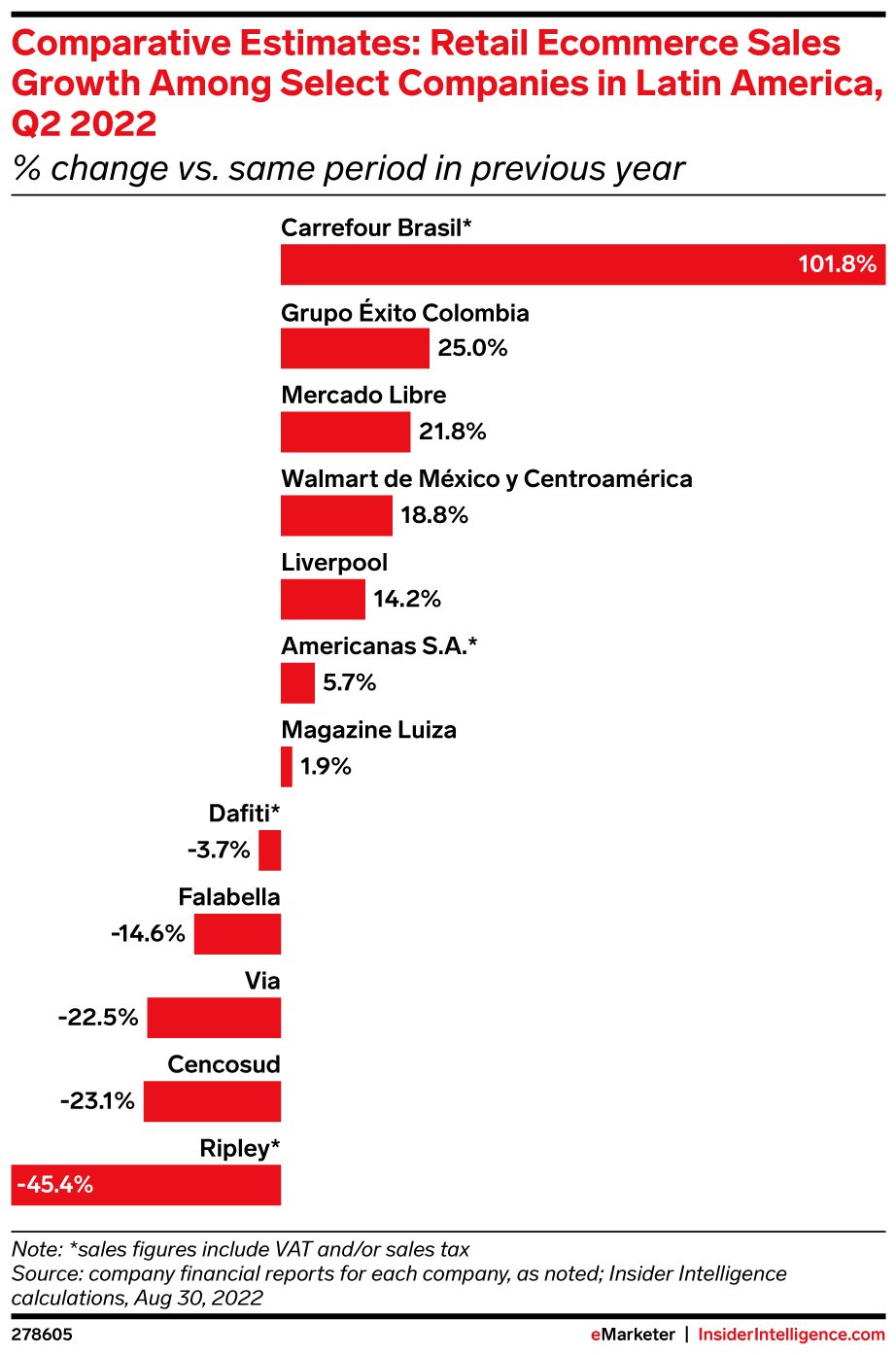

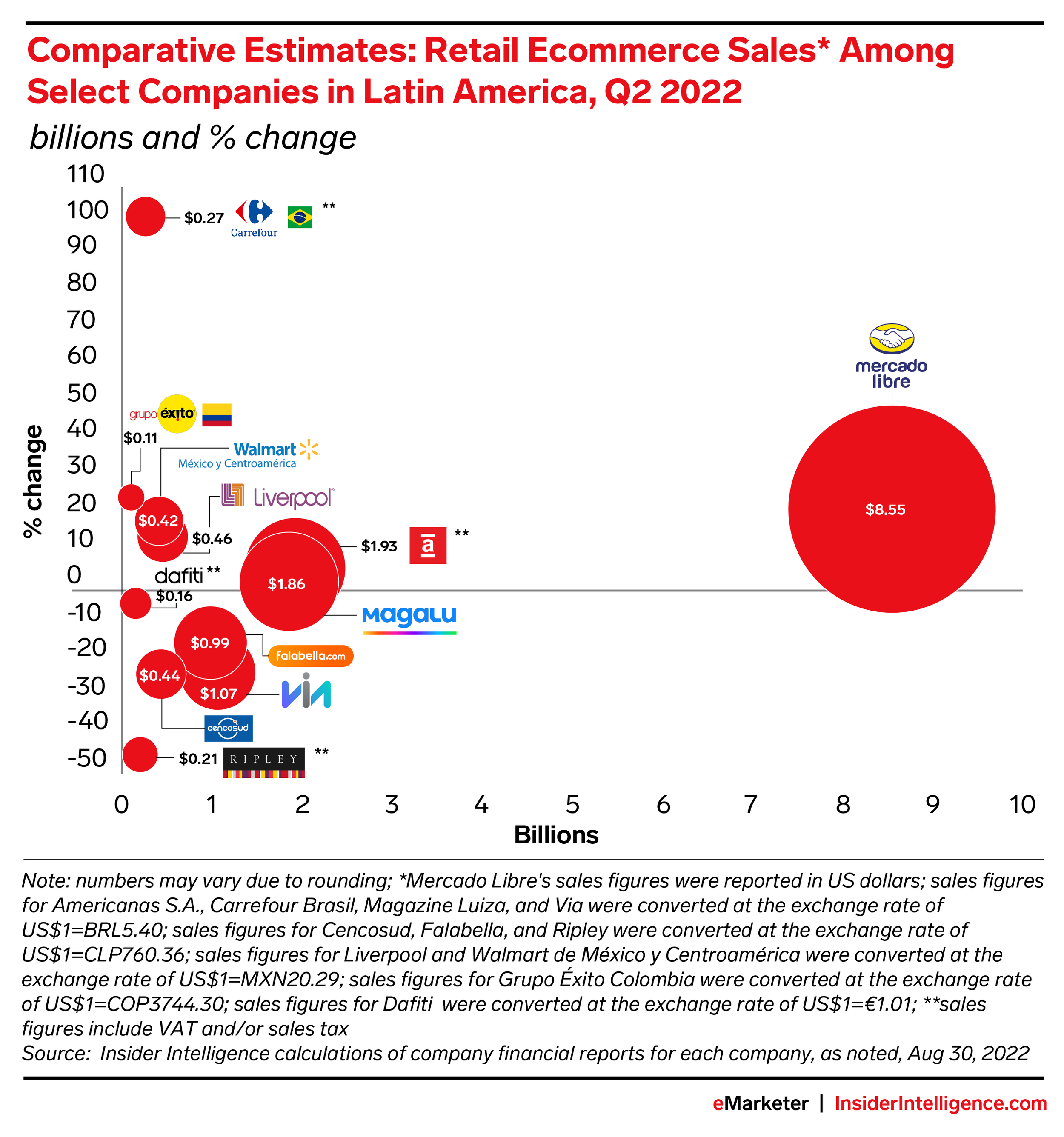

Several retailers are feeling the impact of Latin America’s challenging macroeconomic environment. Stagnant economic growth, rising inflation, and Q2 2021’s high basis of comparison led to a year-over-year (YoY) decline in digital sales for players like Via, Ripley, Falabella, and Cencosud. Others like Carrefour Brasil and Mercado Libre continued to see growth in Q2 2022, despite these challenges.

Ecommerce companies with geographic diversification have moderated economic volatility in Latin America. Players like Falabella, Cencosud, and Mercado Libre have found success in markets beyond their initial countries of origin. Gains seen in Colombia and Mexico—two key growth markets—have mitigated challenging market dynamics in countries like Chile or Brazil. Retailers that can expand into new markets will reap the benefits of Latin America's resilient digital economy.

Physical retail continues to flourish. Retailers have seen in-store sales quickly return to—and even surpass—their pre-pandemic levels. They are now the main driver of total retail sales for nearly every omnichannel retailer we track, save Magazine Luiza.

Subscribers can read the full report here.

KEY STAT: In Q2 2022, five companies saw their retail ecommerce sales decline year over year due to rising inflation, decreases in real wage growth, and a high basis of comparison in the prior year.